When marketing products or services to you, people and companies often make promises. Sometimes they honor their promises, sometimes they don't.

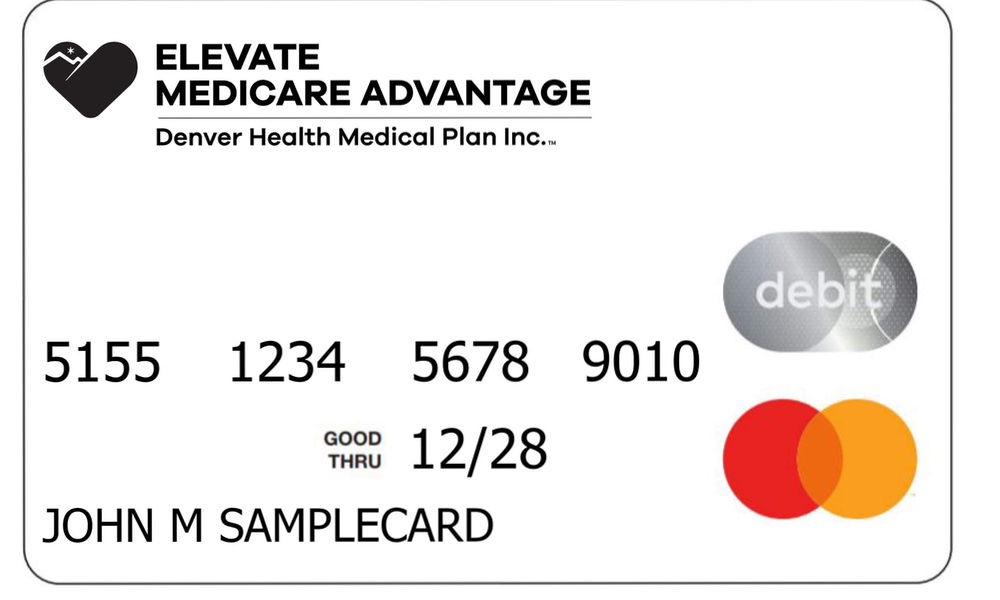

Medicare Advantage programs operate in a competitive market and work hard to lure seniors away from plain, old-fashioned Medicare by offering supplemental benefits that Medicare doesn't cover. These extra benefits include coverage for eyeglasses, hearing aids and dental care — things seniors can really use.

The attraction of Advantage plans in this lucrative marketplace is that these added benefits will make seniors' out-of-pocket health care costs lower.

The question is, do Medicare Advantage programs deliver on these promises or not? Are the added benefits they offer a win for the seniors who choose them?“Supplemental benefits are a major draw to Medicare Advantage, but our findings show that people enrolled in Medicare Advantage have no better access to extra services than people in traditional Medicare, and that much of the cost comes out of their own pockets.”

The answers appear to be “no.”

A team of researchers from Brigham and Women's Hospital, Harvard Medical School, City University of New York and Albert Einstein College of Medicine looked at seniors' out-of-pocket spending for Medicare and Medicare Advantage policies. It found that the cost of Advantage programs is essentially the same as for Medicare, even for Medicare Advantage contracts that include these desirable supplemental benefits.

“Medicare Advantage plans receive more money per beneficiary than traditional Medicare plans, but our findings add to the evidence that this increased cost is not justified,” said first author Christopher L. Cai, a resident in the Department of Internal Medicine in the Mass General Brigham healthcare system.

The team analyzed the responses of over 76,500 Medicare beneficiaries from two continuous surveys done from 2017 to 2021 — the Medical Expenditure Panel Survey and the Medicare Current Beneficiary Survey.

They report Medicare Advantage enrollees were no more likely to receive eye examinations, hearing aids or eyeglasses than traditional Medicare enrollees. In fact, almost half of the enrollees were not even aware that they were entitled to these benefits.

Having a Medicare Advantage plan slightly reduced the out-of-pocket costs for eyeglasses and dentistry. Medicare Advantage and traditional Medicare enrollees paid $205.86 and $226.12, respectively, for eyeglasses (9.0 percent less for Medicare Advantage); $226.82 and $249.98, respectively for dental visits (9.3 percent less for Medicare Advantage). There were no differences for optometry visits or durable medical equipment, a category that covers hearing aids.

There was, however, one major difference: Medicare Advantage plans received $37.2 billion dollars more annually than taxpayers would have spent if beneficiaries had enrolled in traditional Medicare.Medicare Advantage and traditional Medicare enrollees paid $205.86 and $226.12, respectively, for eyeglasses and $226.82 and $249.98, respectively for dental visits.

“Supplemental benefits are a major draw to Medicare Advantage, but our findings show that people enrolled in Medicare Advantage have no better access to extra services than people in traditional Medicare, and that much of the cost comes out of their own pockets,” said senior author Lisa Simon, an assistant professor in the Division of General and Internal Medicine at Brigham and Women's Hospital.

The study is e-published in JAMA Network Open.